INFORMATION 03/02/2024 - IRS 2024: Important Deadlines

Dear Customer,

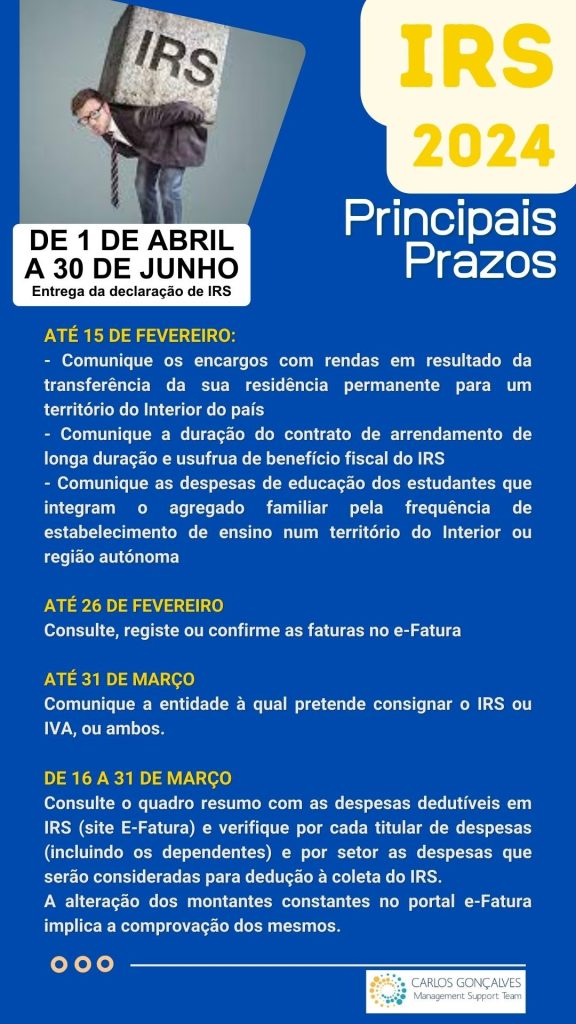

I enclose a quick-read brochure with the main dates for the 2023 IRS (deadline between April and June 2024).

IMPORTANT

1- Clients who have hired our services to supervise deductible expenses in the IRS do not need to worry about this task because it is already on our work agenda.

2- I ask for special attention to the deadline for reporting households for IRS purposes: it is applicable to those who have registered changes to the family structure in the previous year and also to cases of shared custody of minors.

I will also send you information about the new deadline for sending the SAFT billing files (until the 5th of the following month).

IMPORTANT:

Regarding the shipment of SAFT files, as of this month we will only be able to ensure shipment within the legal deadline when customers send us the files at least 3 working days in advance – for various reasons it is not possible to guarantee shipments with fewer delivery days. I remind you that this reporting obligation can be fulfilled automatically by some software – contact your IT support partners for technical clarifications.

FOLLOW OUR FACEBOOK PAGE TO KEEP UP WITH OUR POSTS AND UPDATES