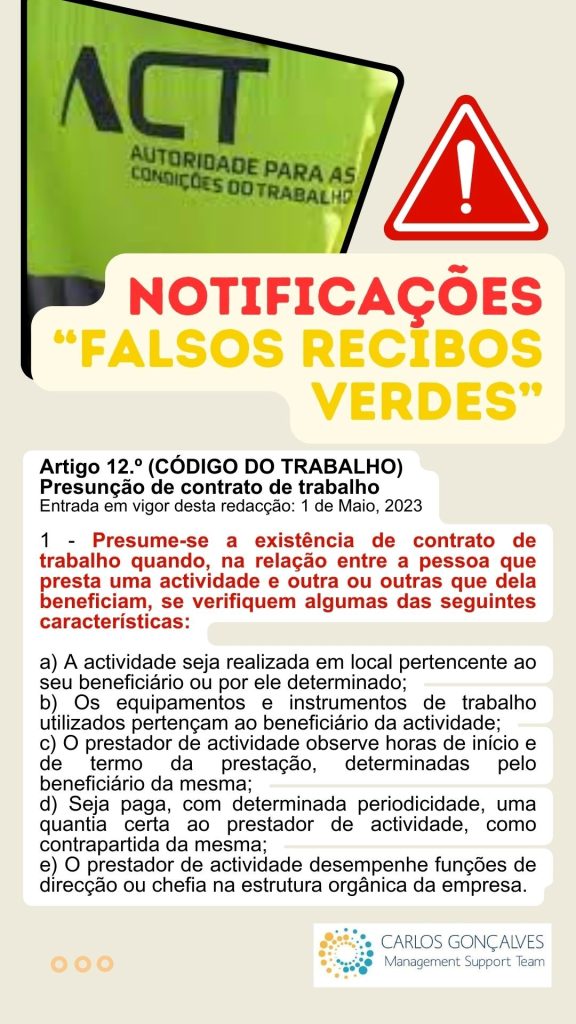

INFORMATION 03/02/2024 - LEGAL PRESUMPTION OF FALSE GREEN RECEIPTS

Notifications from ACT – Authority for Working Conditions

According to Article 12 of the Labour Code (Presumption of employment contract), the following situations constitute a situation of legal employment relationship, mainly applicable to situations of green receipts:

"(a) the activity is carried out in a place belonging to or determined by the beneficiary;

(b) the equipment and work tools used belong to the beneficiary of the activity;

(c) the activity provider observes the start and end times of the service, determined by the beneficiary of the service;

d) A certain amount is paid, at a certain interval, to the activity provider, in return for the same;

e) The activity provider performs management or leadership functions in the organisational structure of the undertaking."

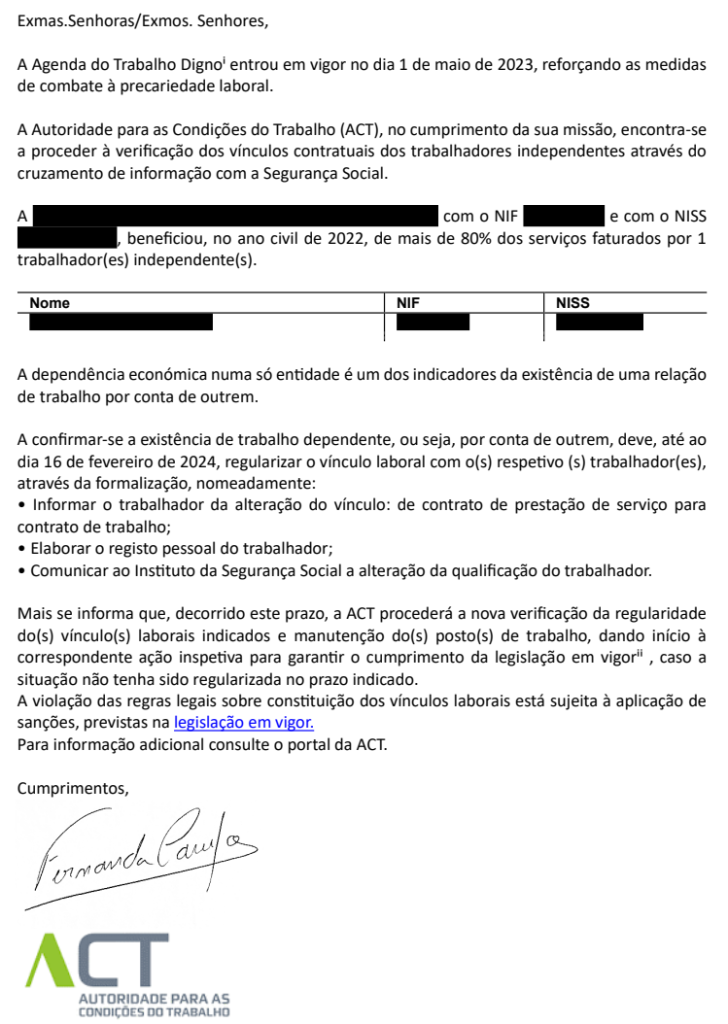

In this context, thousands of companies are currently receiving automatic notifications from ACT to suggest the classification as an employment contract applicable to situations in which holders of self-employed income (green receipts) have received more than 80% of their income from a single entity in the previous year. At the moment, these companies are faced with the need to prove whether these holders of green receipts are effectively and legitimately service providers... if this is not the case, ACT expects that the identified beneficiary will be promptly reported as an employee and that salary deductions and contributions will begin in the context of the Labor Code.

Court which, as we know, acts preferentially in defence of the worker and not of the employer.

If notified:

- Send us a copy of the notice so we can follow up on your defense process

- You should consult your lawyer or solicitor to review the presumption of employment and confirm whether the evidence you can present is legally acceptable to rule out the imputation made against you

- Consider this matter as an urgency and priority: this notification is subject to legal deadlines from which failure to respond presumes acceptance of the terms of the identification of the beneficiary and entails serious consequences for the company

I know that this is a complex subject, difficult to specify because the way of interpreting the letter of the law depends on the details of the law on a case-by-case basis.

I leave here a link to Youtube video of the President of the Order of Certified Accountants where in a few minutes she can explain the legal framework of the issue, the involvement of the certified accountant and the need to resort to lawyers because the process can have serious consequences .

As usual, you can count on our full support in whatever way we can to help you if you receive any notification of this kind. I take this opportunity to remind you that in our monthly communications, whether through the payment map or through the sending of salary receipts, it is customary to create short summaries and alerts of the main facts related to labor issues - whenever you detect any information that needs additional clarification, do not hesitate to contact us. Aproveito para recordar que nas nossas comunicações mensais, sejam através do mapa de pagamentos, seja através no envio dos recibos de salário, é hábito criar pequenos resumos e alertas dos principais factos relacionados com questões laborais – sempre que detetem alguma informação que precisem de esclarecimento adicional não hesitem em contactar-nos.

Copy of a relevant notification of ACT